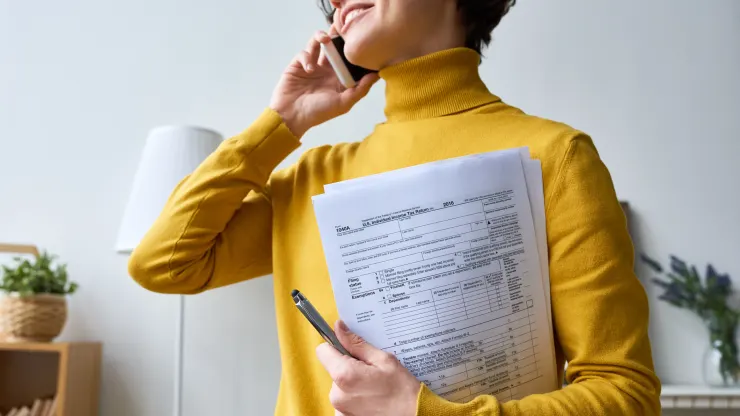

Most Americans will use their tax refund to bolster their finances amid economic uncertainty, stock market volatility and lingering inflation.

More than one-third of Americans are saving their tax refund this season and 44% have earmarked the funds to pay off debt or bills, according to the CNBC Your Money Financial Confidence Survey, conducted in partnership with Momentive.

Those percentages were even higher for younger respondents — closer to one-half for Americans ages 18 to 34 years old — based on the March poll of more than 4,300 consumers.

As part of its National Financial Literacy Month efforts, CNBC will be featuring stories throughout the month dedicated to helping people manage, grow and protect their money so they can truly live ambitiously.

70% of Americans are feeling financially stressed, new CNBC survey finds

Most Americans are using tax refunds to boost savings or pay off debt

58% of Americans live paycheck to paycheck: CNBC survey

How smart are you about your money? Test your knowledge now

Here’s how to handle stress over market volatility, financial advisor says

These steps can help close the racial retirement gap. ’It’s not what you make, it’s what you keep’

View More

A recent Bankrate survey also found that tax refunds are important to most Americans’ financial situation, and that paying off debt and boosting savings are top priorities this year, which is similar to past findings.

“People tend to use this money very practically,” said Ted Rossman, a senior industry analyst at Bankrate. “This is something that we see year after year.”

As of March 31, the IRS had issued nearly 63 million refunds, with an average payment of $2,910, compared to $3,226 at the same point in the filing season last year, the agency reported Friday.

Refunds are down 10% at a time when other costs are up significantly.

Ted Rossman

SENIOR INDUSTRY ANALYST AT BANKRATE

“Refunds are down 10% at a time when other costs are up significantly,” Rossman said. Although inflation has been trending downward, the annual rate was still at 6% in February, including volatile food and energy costs.

“This may be the largest windfall that a typical household receives all year,” Rossman said. “So it’s unfortunate that the amount is getting smaller at a time when other things are costing more.”

Some 45% of Americans expect to receive or have already received a tax refund this season, according to the CNBC survey.

How to pick between savings and debt payoff

Paying off high-interest debt, like a credit card balance, is “always a prudent option” for your tax refund, said Ken Tumin, founder and editor of DepositAccounts.com, a website that tracks the most competitive options for savings.

“The average credit card rate is a little bit over 20% these days, which is the highest since we started measuring almost 40 years ago,” Rossman said. “So if you have credit card debt, putting some of this refund money towards that debt is a really good choice.”