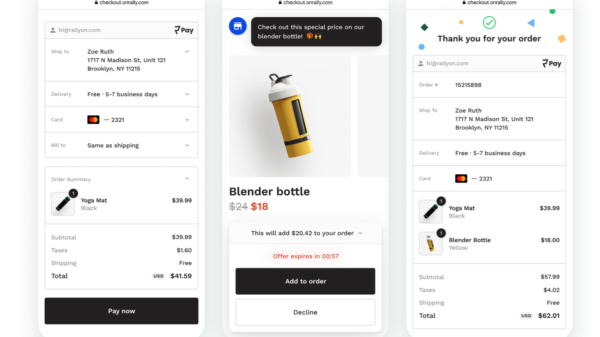

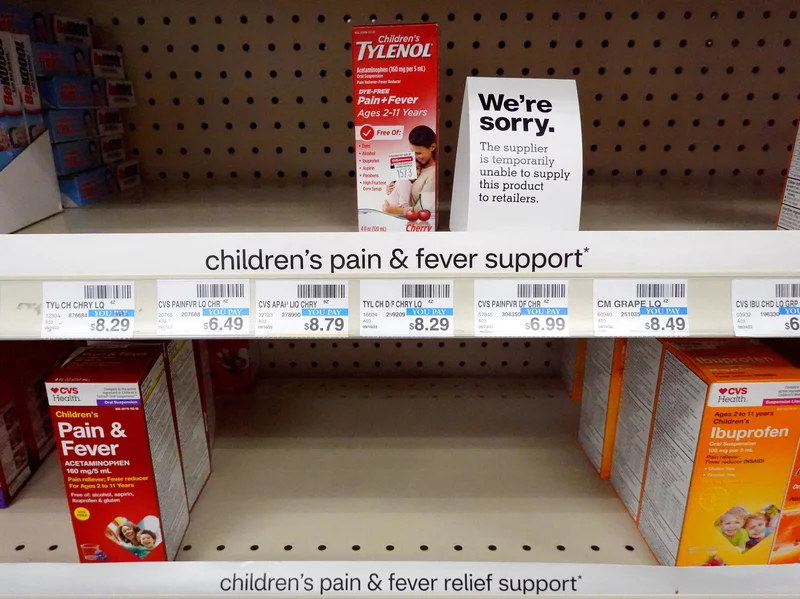

It’s not just your imagination: Drugs such as children’s flu medication, common antibiotics and ADHD treatments are getting harder to buy, according to a Senate report published Wednesday.

Democrats on the Homeland Security and Governmental Affairs Committee say the number of new drug shortages rose by 30% between 2021 and 2022, an increase that has had “devastating consequences” for patients and doctors.

Towards the end of 2022, a peak of 295 individual drugs were considered in short supply — impacting treatment for everything from colds to cancer.

What’s behind these shortages?

The report says the pandemic stretched supply chains thinner, right when demand for over-the-counter respiratory relief was spiking.

But even before the pandemic, the U.S. had struggled to overcome essential supply shortfalls. More than 15 “critical care drugs,” such as common antibiotics and injectable sedatives, have remained in short supply for over a decade, the report says.

Reliance on foreign manufacturers is the top reason the U.S. struggles to head off shortages, says Sen. Gary Peters, the Michigan Democrat who chairs the Homeland security committee.

“Nearly 80% of the manufacturing facilities that produce active pharmaceutical ingredients […] are located outside of the U.S.,” he said during a hearing about the issue on Wednesday.

That’s also creating an “unacceptable national security risk,” he says.

The Administration for Strategic Preparedness and Response told the committee staff that 90 to 95% of injectable drugs used for critical acute care rely on key substances from China and India. In other words, a severe breakdown in the supply chain could leave emergency rooms scrambling.

What could be done to solve the drug shortages?

The report also found that the federal government and industry regulators lack visibility into the supply chain for such drugs, making it harder to predict shortages. The Food and Drug Administration doesn’t know, for example, the amount of starting material a manufacturer has available, or, in some instances, how many manufacturers are involved in producing the final drug.

And even in cases where they do have this kind of data, they’re failing to retain it in ways that would help predict shortages. The data stays “buried in PDFs,” the report says. To fix this, the FDA could create a central database of starting-materials levels and track production volume.

Committee Democrats are also recommending that a team of federal agencies pair up to perform regular risk assessments on the supply chain, increase data sharing requirements on private manufacturers, and then increase data sharing between agencies and industry partners.

Increasing federal investments in drug manufacturing would also help wean the U.S. drug supply off foreign countries, according to the report. That might mean incentivizing domestic production or building academic-private partnerships to advance research and development capabilities.

Peters said he’s planning to propose legislation to try to make these long-term recommendations a reality in the near future.