If the city of San Francisco ever needs a homegrown culinary ambassador, chef Kathy Fang would be an ideal candidate.

Aside from a brief time with her family in Sacramento and the years she studied at University of Southern California and Le Cordon Bleu College of Culinary Arts-Pasadena, the San Francisco native has lived — and eaten and cooked — all around The City: in Chinatown, Nob Hill, the Sunset and Pacific Heights. She attended Saint Francis of Assisi in North Beach for preschool, Jefferson Early Education School for elementary school and Convent of the Sacred Heart for middle and high school.

“Yes, I’ve really gotten to experience San Francisco,” she said, by phone from her home in SoMa. “The only time that I really ever left was to go to college.”

Many know Kathy Fang from House of Nanking, the Kearny Street dining institution opened by her father and mother, Peter and Lily Fang, in 1988. Kathy spent most of her non-school time in her parents’ restaurant and, along with her father, co-founded her own eating establishment, Fang, in SoMA in 2009, which serves dishes influenced by both Northern and Southern China’s cuisine. Along the way, she became a celebrity chef via the Food Network.

She and her father are the primary subjects of “Chef Dynasty: House of Fang,” a six-part docu-series about the two generations of chefs that premieres on Tuesday. The first episode, “Old School, New Food,” airs 9 p.m. Dec. 27 on the Food Network. The junior Fang, a two-time “Chopped” champion, spoke with The Examiner about the unexpected advantages of growing up in a restaurant, food media trends and what she hopes people will learn from “House of Fang.”

Did you grow up with families also involved in the San Francisco restaurant business?

My parents work at the restaurant every single day, taking off only Thanksgiving and Christmas Eve. And the restaurant is open all day, so they never leave. Because of that, we never had the opportunity to hang out with others in the food industry.

What experiences helped prepare you to be on TV?

Growing up in the restaurant taught me how to talk to people I didn’t know. I was there pretty much anytime that I was not in school, and I spent a lot of time sitting at the counter speaking with customers. So at a really young age, I learned to just talk to people. I think that aspect has been really helpful, because not all restaurateurs or chefs are comfortable being social.

When I opened Fang, a lot of people said, “Hey, have you ever thought about being on food TV? Because you’re very friendly, you can talk about food and you don’t seem shy.”

How have cable TV, the internet and social media changed people’s attitude toward food?

House of Nanking was successful because my Dad was doing things that were different from typical Chinese cuisine. He wasn’t thinking of modernization. He was thinking, “If I want to make my food stand out, I need to do something a little different.” He was putting riffs on classic dishes and creating a better version.

These days, a lot can be dictated by social media and food trends. Many are just fads, so how much of it should you follow and how much of it should you ignore? For me, 90% of my inspiration comes from my travels and the foods I eat. I’ll ask myself, “Oh, my God, why is this so amazing? How can I implement something like this into my dish?”

What generational differences do you see between yourself and your parents as restauranteurs?

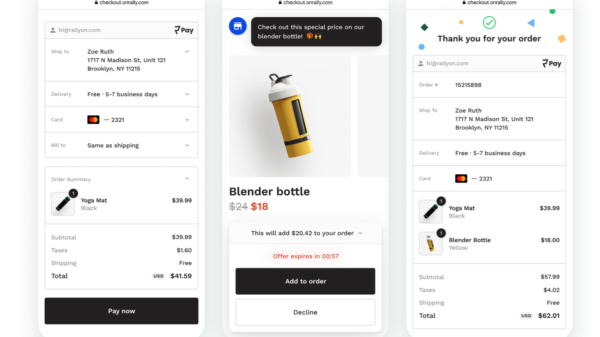

The modernization aspect is harder for my parents. It took me forever to try to convince them to stop writing their orders. “You need a POS (point of sale),” I told my Dad about 15 years ago, when I was still in school. “It’ll make things more efficient.”

Then it took the pandemic for them to finally accept delivery apps. They said, “We do great business with people walking in doing takeout. With delivery, the food will just sit there and take space.”

When I did Fang with my Dad, it was a clean slate. We were 50/50, and my Dad just said, “As long as I don’t have to manage how this stuff works.”

House of Nanking is archaic. Everybody has been working there for over 20 years, and they’re used to doing things a certain way. My Mom runs the show there and is very against any sort of change.

House of Nanking and Fang are both so visually alluring, from the signs and the buildings to the food itself. That must translate well on Instagram.

Well, my Dad’s not a fan of social media at all. Because of this stuff, people don’t eat right away. And that’s one of our biggest pet peeves: A lot of the food that we serve, we want you to eat it right away so that you get the full flavor. It needs to be hot. If there’s something crispy, it only stays crispy for a certain period of time. If there’s something cold on it, you’ve got to eat it now to get that whole explosive bit. Don’t let it sit.

My Dad is so old school that he’ll hover around the table. And if he sees that customers are not eating, he’ll say, “You need to eat it! It’s not going to be good if you wait any longer.”

What are your expectations for the series?

We hope that the restaurant will get even busier, of course. And I’d like more people to know House of Nanking’s story. I think a lot of people know about it, but not the story behind it — how it was created after my parents immigrated here with less than $40 in their pockets, thinking they’d go to school and get an office job.

Also, I have a long-term goal of wanting to take what my parents built, and what we’ve created with Fang, and develop a lifestyle brand that’s deeply rooted in Chinese culture. That would include everything from sauces and cookware to plates and chopsticks. Maybe one day you’ll walk into a Walmart, Target or a Whole Foods, and there will be plates designed by my family or a sauce tied to one of our recipes.