The U.S. flag is seen on a building on Wall St. in the financial district in New York, U.S., November 24, 2020. REUTERS/Brendan McDermid

WASHINGTON, March 28 (Reuters) – The U.S. Securities and Exchange Commission (SEC) on Monday proposed expanding the definition of broker-dealers and mandating that Principal Trading Firms (PTFs) must register with the agency in a bid to enhance market resiliency and help level the playing field.

The Wall Street regulator said its proposal, which is subject to public consultation, aims to expand the definition of a dealer as “one that engages in a routine pattern of buying and selling securities that has the effect of providing liquidity to other market participants,” which would capture a range of activities it sees as critical to the agency’s monitoring of systemic risk.

“In recent years, we’ve seen a number of high-profile events in markets with significant participation by PTFs. Tremors in the Treasuries markets in 2014, 2019, and at the beginning of the COVID crisis in 2020 demonstrate the importance of the SEC’s oversight of dealers,” said SEC Chair Gary Gensler in a statement.

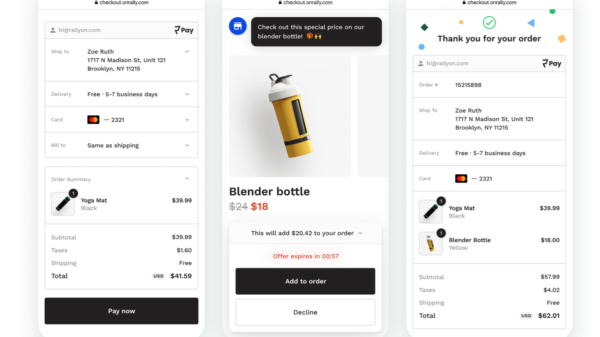

Monday’s proposal specifies that broker dealers who routinely make comparable purchases and sales of the same or substantially similar securities in a day must register with the regulator.

Dealers who “routinely express trading interests that are at or near the best available prices on both sides of the market and that are communicated and represented in a way that makes them accessible to other market participants” must also be registered, the SEC said, in addition to mandating that a dealer must register with the agency if she earns revenue primarily from capturing bid-ask spreads, by buying at the bid and selling at the offer.

The regulator also seeks to scrutinize dealers who capture any incentives offered by trading venues to liquidity-supplying trading interests.

Regulators have long argued that high-frequency trading, a computerized strategy that can move billions of dollars in fractions of a second, carries risks in the U.S. government bond market that threaten the ability of the market to function, as well as the ability of investors to fairly value assets.

The SEC, as the U.S. market’s regulator, should require that such trading firms comply with capital and record-keeping rules and be subject to periodic exams, much like equities and corporate bond markets, Gensler has argued.

Our Standards: The Thomson Reuters Trust Principles.

Washington-based reporter covering U.S. regulation at the Securities and Exchange Commission and the Consumer Financial Protection Bureau, previously e3xperience in Ecuador, alumnus of Morehouse College and Northwestern University’s Medill School of Journalism.

Sign up to our legal newsletter for a smart look at the day’s headlines concerning the practice of law.

The news and media division of Thomson Reuters, is the world’s largest multimedia news provider, reaching billions of people worldwide every day. Reuters provides business, financial, national and international news to professionals via desktop terminals, the world’s media organizations, industry events and directly to consumers.

Build the strongest argument relying on authoritative content, attorney-editor expertise, and industry defining technology.

The most comprehensive solution to manage all your complex and ever-expanding tax and compliance needs.

The industry leader for online information for tax, accounting and finance professionals.

Access unmatched financial data, news and content in a highly-customised workflow experience on desktop, web and mobile.

Browse an unrivalled portfolio of real-time and historical market data and insights from worldwide sources and experts.

Screen for heightened risk individual and entities globally to help uncover hidden risks in business relationships and human networks.